Trade Talk Time-Out: How a Political Ad Just Affected Aluminum—and What Comes Next

- Harrison Shrair

- Oct 27, 2025

- 4 min read

On October 24, 2025, President Trump said he was terminating U.S.–Canada trade negotiations after Ontario aired a high-profile anti-tariff ad that spliced Ronald Reagan audio to argue against tariffs. Ontario has since said it will pause the campaign so talks can resume, but for now, the diplomatic chill is real. TIME+2The Guardian+2

Why this matters for aluminum (and why the Midwest Premium “jump” narrative makes sense)

Aluminum is uniquely exposed to trade policy because the U.S. imports a large share of its supply. When tariffs are threatened or talks break down, import costs and logistics risks rise—and the market often prices that risk into the Midwest Transaction Premium (MWP), the surcharge buyers pay on top of the LME price to get physical metal delivered in the Midwest. We saw this movie before: in 2018, as Section 232 aluminum tariffs loomed, the U.S. premium leapt ~90% in a matter of weeks. In early 2025, as new tariff actions returned, U.S. physical premiums ran up to record territory. This backdrop explains why traders reflexively bid up the premium—or at least firm offers—whenever Washington and Ottawa head for the rocks. Reuters+2Yahoo Finance+2

TL;DR: headlines that raise the probability of higher duties, expanded quotas, or stickier frictions tend to push the MWP higher, even before any policy is formally inked.

The ripple: higher prices for anything with aluminum

Because the MWP is assessed on a delivered, duty-paid basis, it acts like a broad pass-through cost—impacting beverage cans, autos, appliances, construction products, wiring, and more. Buyers pay that uplift regardless of whether a given ton actually paid the tariff; that’s how a benchmark premium works. In practical terms, a firmer MWP inflates input costs for downstream manufacturers and, eventually, consumer prices. Industry groups have long argued this “premium-plus-tariff” structure magnifies the burden on end users. S&P Global+1

Why the premium can later crash—and why that’s risky

Premiums are risk premia. If the policy shock subsides—say, talks resume, carve-outs appear, courts limit tariff scope, or imports reroute—MWP can reset hard and fast. We saw that after the first Section 232 cycle; the premium spiked, then eased back as supply chains adjusted and exemptions evolved. A sharp downdraft does not mean demand collapsed; it usually means scarcity expectations faded. For producers, traders, and scrap processors who built inventory or hedged at elevated premia, a sudden slump can:

Compress margins on fixed-price or lightly hedged contracts.

Trigger P&L volatility if hedges covered LME but not the basis (MWP).

Snarl flows if buyers pause to renegotiate or wait out the slide. MetalMiner

New precedents this market just set for the scrap industry

This year’s run-up established some durable lessons:

Policy headline risk = basis risk. 2025 proved that political catalysts can push the U.S. premium to record levels, independent of LME. Scrap sellers and consumers must treat MWP as a separate, actively managed exposure—not a rounding error. Yahoo Finance

Benchmark mechanics matter. With Platts/CME expanding tools to increase transparency in premium assessments, more players can hedge or at least observe the basis in nearer real time. That makes basis management a front-office competency, not a back-office afterthought. News Release Archive

Contract design is strategy. Deals that float on LME + MWP, with explicit language for extraordinary tariff or quota changes, performed far better than flat-price agreements. Expect more MWP-explicit scrap and cansheet contracts going forward. (Inference based on observed premium dynamics and market structure changes; see sources on record MWP and methodology updates.) Yahoo Finance+1

Hedge both legs. The 2018 and 2025 episodes reaffirm: hedging LME alone leaves you naked on the premium. CME/Platts MWP swaps exist for a reason—basis risk is real and monetizable. CME Group

What to watch next (signals that move MWP)

Policy headlines: Any White House move that raises or relaxes Canadian tariffs, or court rulings affecting tariff authority, can reprice the premium quickly. The Washington Post

Official talks: Concrete steps to restart U.S.–Canada negotiations (or Ontario fully pulling the ad) reduce risk premia; stalemates do the opposite. AP News

Import flows & outages: Shifts in P1020 inflows, freight to the Midwest, or smelter/mill disruptions alter local scarcity—and the premium. (Background on how the premium reflects delivered, duty-paid Midwest availability.) S&P Global

Bottom line

The ad flap didn’t change the physics of aluminum—but it changed the probabilities around trade friction. Markets price probabilities, not certainties. That’s why the Midwest Premium tends to “jump” on headline risk and why it can snap back if the risk recedes. For operators in scrap and secondary, 2025’s record-high premium era set a clear precedent: treat basis risk like a core input cost, bake MWP explicitly into contracts, and align hedges to both LME and the premium so you can keep shipping—no matter which way the politics blow. Yahoo Finance+2Reuters+2

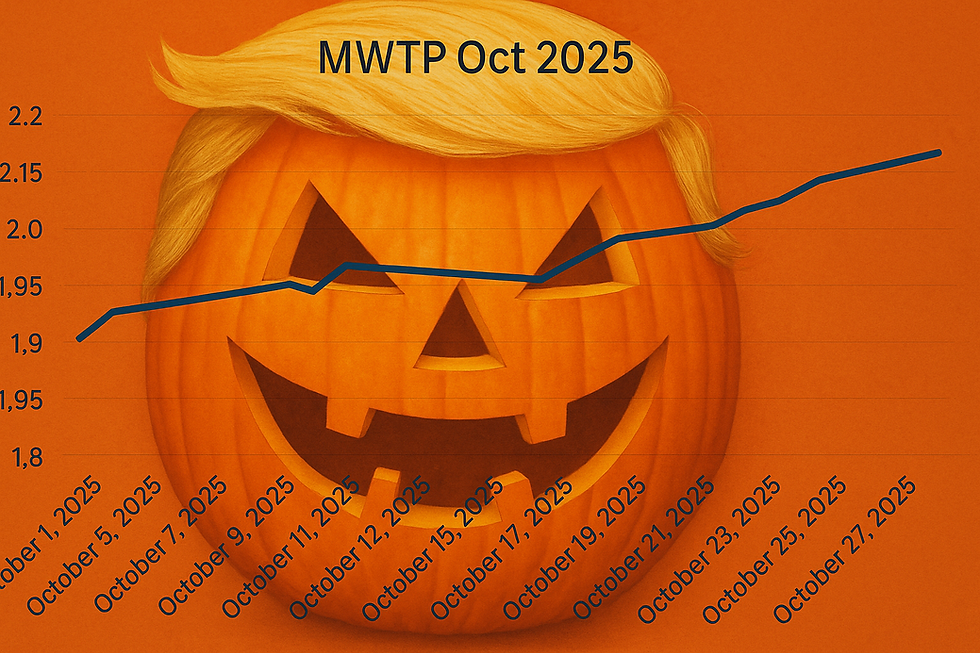

Here is the trend of the LME AL and the Midwest premium for the last month.

For more aluminum market insights, check out our blog on our website, follow us across all our social media, and join our pricing list for the best aluminum offers with unbeatable logistics!

.png)

Comments