Aluminum Prices Make History

- Harrison Shrair

- Oct 6, 2025

- 3 min read

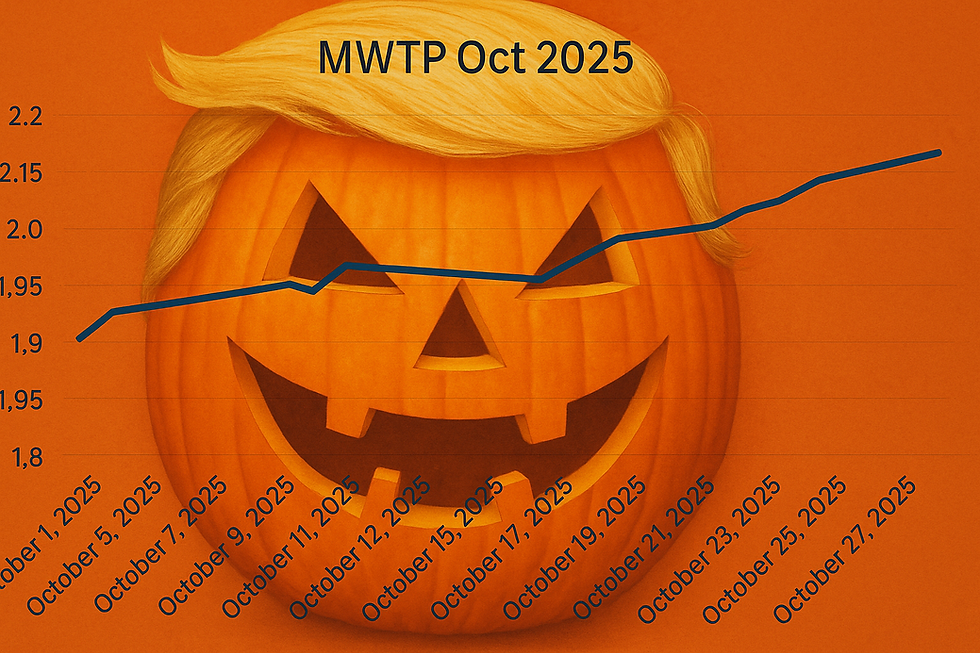

The aluminum market just hit a historic milestone. The Midwest Transaction Price (MWTP) — a key benchmark for domestic aluminum prices in the U.S. — has broken through the USD $2.00/lb mark, making headlines and rippling across multiple industries.

As of today, the MWTP continues to climb after already reaching record-breaking levels in the aftermarket this past Friday. Looking at last week, London Metal Exchange (LME) aluminum prices closed about $0.015/lb higher, and the MW premium soared by $0.033/lb. In total, the full transaction price finished about 5 cents higher than where it began the week — a trend that is still gaining momentum today.

So, what’s fueling this historic aluminum rally? Let’s break it down.

1. Tariff Talk Sparks the Fire

One of the most immediate catalysts behind this price surge was the revival of tariff threats by President Trump. Any mention of import tariffs on aluminum or metals tends to jolt the market, ever since he took office.

Trump’s rhetoric has reignited fears of supply constraints and higher costs, especially since tariffs would increase the price of imported aluminum. As a result, the Midwest premium — a key measure of the domestic price over the LME base — surged, reflecting both shrinking supply and anticipatory buying from manufacturers.

2. The Plastic-Aluminum Tug of War

In a surprising twist, the ongoing decline in plastic demand hasn’t relieved any pressure on aluminum — in fact, it’s adding complexity.

Canada’s ban on single-use plastics removed a major buyer from the U.S. market. This could have shifted packaging demand back to aluminum, especially among beverage companies. However, concerns over soaring aluminum prices have forced companies to reconsider this move.

Instead of PET bottles demand recovering, it has collapsed. Scrap PET bottle prices have fallen dramatically, from the low $0.20s per pound earlier this year to an astonishing $0.005/lb. The expected offset in demand never materialized, leaving PET recyclers and processors in a pricing free fall.

3. Volatility in Copper and Steel

Broader metal market instability is adding to the uncertainty. Copper and steel have seen sharp price swings in recent months, further complicating procurement strategies for manufacturers and investors alike.

The unpredictability in these markets only strengthens aluminum’s appeal as a more “stable” hedge — ironically, even as it enters its own period of historic volatility.

4. Shifting Scrap Dynamics in North America

Cross-border price dynamics are also at play. Canadian mills, which traditionally source scrap aluminum to meet production needs, have now pivoted to purchasing prime aluminum instead.

Why? It turns out that, with U.S. scrap prices climbing due to tight domestic demand, it’s cheaper for Canadian mills to buy prime aluminum — a higher-grade and normally more expensive material — than to compete with U.S. buyers for scrap.

This shift adds further stress to the U.S. scrap market, tightening supply and nudging prices even higher.

Where Does the Market Go From Here?

While predicting commodity markets is never easy, all signs suggest the aluminum rally isn’t over yet. Until there’s clarity on trade policies, supply availability, and broader market stability, we are predicting the Midwest premium will remain elevated, for the time being, and volatility will continue to define the aluminum landscape.

If you’re a manufacturer, supplier, or end-user, now’s the time to watch the market closely, revisit sourcing strategies, and evaluate how global trade politics could reshape your cost structure in the months ahead.

Given this information, there are a lot more factors at play, like the war in Ukraine, mine collapses, Gold rallying, employment rates, bills being passed, Fed rate cuts, mills shutting down for the year, etc. No matter what, it’s always best to make an informed decision and have a relationship with a consumer who keeps you informed.

For more insights or prices for your scrap aluminum, contact Wes Foster wf@labrecy.com

.png)

Comments