Market Recap: Key Factors Impacting Aluminum Scrap Trading This Week

- Harrison Shrair

- Sep 29, 2025

- 3 min read

Labrador Aluminum Market Report 09/29/2025

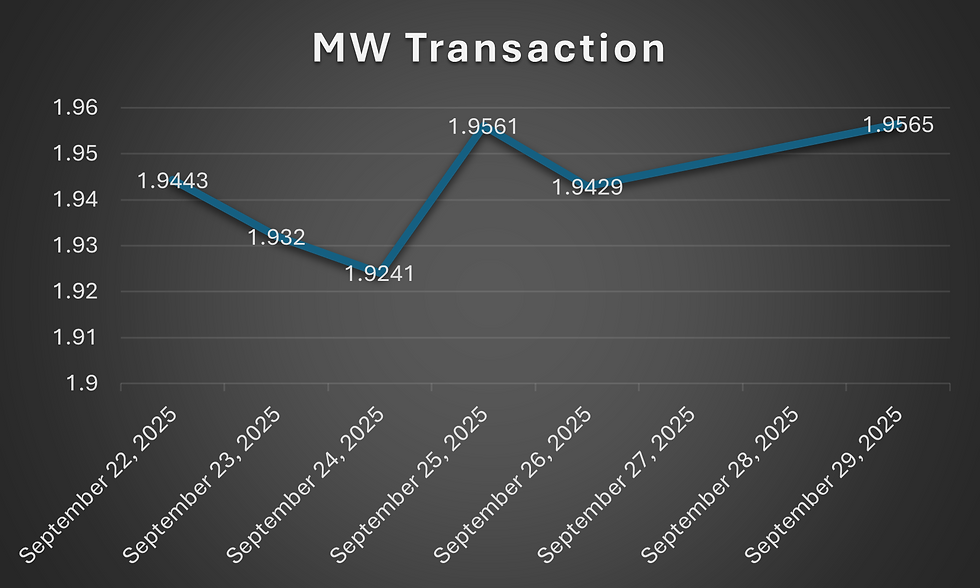

Since last Monday, we have seen the LME Aluminum Market go into Backwardation multiple times. The Lowest LME AL price was at the low of 1.1896 in the middle of last week to 1.212 today, but at a high of 1.2061 last week. The Premium was at a low of 0.7345 last week with a jump to 0.75 on Thursday, then back down to 0.7445, where it remains today. The Midwest Transaction we saw a low of 1.9421, where both the LME and premium were at their lows; and the transaction high was the 25th at 1.9561, which is right below where the market is hovering today.

The aluminum scrap trading market saw notable volatility this past week, influenced by a mix of macroeconomic uncertainty, disruptions in global mining operations, and shifting energy policies in the U.S. While aluminum fundamentals remain relatively stable, several external factors are contributing to fluctuations in sentiment and pricing across the broader metals complex.

Here are the key developments traders and market participants should be aware of:

1. U.S. Government Shutdown Looms – Potential Market Disruption

A potential U.S. government shutdown has once again entered the spotlight. Lawmakers scrambled this Monday in a last-minute attempt to strike a deal and avoid a funding lapse. For context, a government shutdown occurs when Congress fails to pass—or the President declines to sign—appropriations legislation needed to fund federal operations.

Such shutdowns can delay infrastructure projects, slow down customs operations at ports, and cause uncertainty across various markets, including metals. For aluminum scrap dealers and recyclers, a funding gap could delay construction or transportation projects that rely heavily on recycled aluminum, potentially dampening short-term demand.

2. Copper Supply Shock Ripples Across Base Metals

Goldman Sachs made headlines on Thursday by cutting its global copper mine supply forecast for 2025 and 2026, following a major disruption at Indonesia’s Grasberg mine—currently the world’s second-largest copper producer. The mine was forced to declare force majeure after a September 8 mudflow incident left several workers trapped underground.

Though the incident directly impacts copper, its effects are being felt across the base metals market, including aluminum. Copper often serves as a barometer for industrial demand, and any supply imbalance can lead to speculative movements in other metals. Traders should keep a close eye on fund flows and pricing patterns as sentiment may continue to spill over into the aluminum market.

3. Coal Makes a Comeback? U.S. Administration Pushes for Expanded Mining

In a significant policy shift, the Trump administration announced plans on Monday to expand coal leasing on federal lands and invest hundreds of millions of dollars to bolster coal-fired power generation. This marks a renewed effort to reverse coal’s decline in the face of environmental regulations and growing competition from natural gas and renewables.

While this may seem unrelated to aluminum at first glance, the move has implications for energy pricing and carbon policy, both of which influence the cost structure of aluminum smelting and production. A stronger coal presence in the U.S. energy mix could impact electricity pricing trends, particularly in regions where smelters are still active. Additionally, changes in environmental policy may also alter long-term investment strategies in green aluminum and recycled content.

Looking Ahead

The aluminum scrap market remains sensitive to a wide range of global and domestic influences. While none of the above events directly target aluminum, their combined effect could shift market expectations, pricing trends, and trade flows in the coming weeks. Traders should remain cautious, especially as uncertainties around fiscal policy, energy trends, and global mine supply continue to evolve.

Stay tuned for further updates and analysis as we monitor how these developments unfold.

For scrap aluminum quotes and more insights, contact Wes Foster at wf@labrecy.com

.png)

Comments